I think the FED is like Yondu from The Guardians Of The Galaxy, it's arrow liquidity either kills or grinds the market.

First, let's take a quick look at what happened in the Adani Group's fiasco.

"Darker questions about India’s credibility as a destination for global investors".

As we all know, countries like India are dark and they tend to hide to attract investors because there is a huge potential in the growth side. India is also good in IT but the thing is countries like India businessmen are always too close with the politicians which causes corruption to happen continuously.

Hindenburg Research disclosed, in part,

"After extensive research, we have taken a short position in Adani Group Companies through U.S.-traded bonds and non-Indian-traded derivative instruments"

Does growth come out at what cost? Well, It also may be taken out instantly as we see $108 Billion wiped out at the market cap.

As all corrupt and fraud would try to defend themselves, Adani stated,

“We are evaluating the relevant provisions under US and Indian laws for remedial and punitive action against Hindenburg Research.”

Adani also called off its Rs 20K crore follow-on public offer (FPO) and said money will be returned to investors.

You can read more about Adani fiasco in here:

Let's keep Adani out of our main focus because certainly some has benefited from it more than others,

On the real side, Americans’ disposable income dropped by more than $1 trillion. This was the second-largest drop – since the Great Depression.

What Is Disposable Income?

Disposable income, also known as disposable personal income (DPI), is the amount of money that an individual or household has to spend or save after income taxes have been deducted.

So the FED liquidated us with helicopter money and it was like never seen, even in Bernanke times, the cost is DPI going down, and people take any job they can find because the cost of basic living items are up like crazy!

You can find Inflation numbers here.

Also, US Government supports Ukraine with the taxpayer's money, putting another burden on the taxpayer, and getting itself deeper into darkness.

How about a soft landing?

The term soft landing came to the forefront of Wall Street jargon during Alan Greenspan’s tenure as Fed Chairman. He was widely credited with engineering a soft landing in 1994-1995. The media has also pointed to the Federal Reserve engineering soft landings economically in both 1984 and 2018.

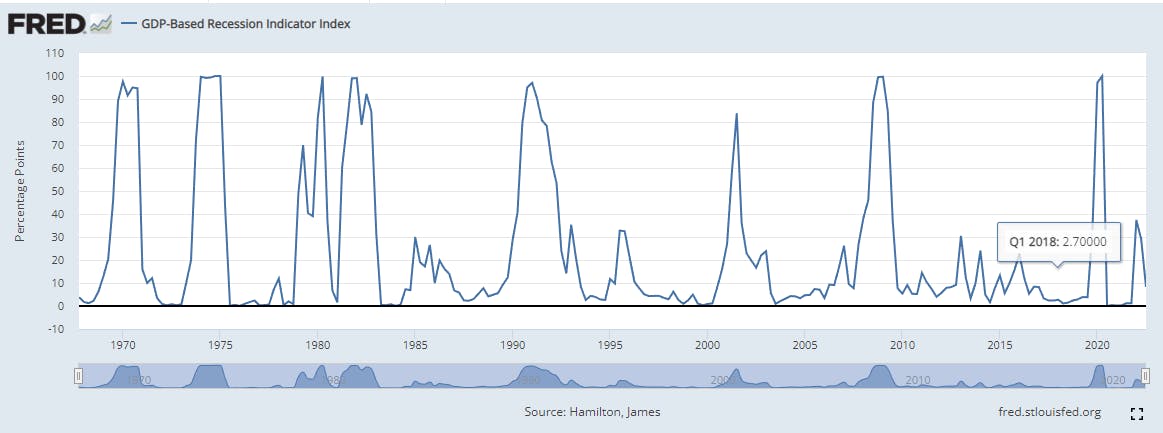

The GDP-Based Recession Indicator Index here

This index measures the probability that the U.S. economy was in a recession during the indicated quarter. It is based on a mathematical description of the way that recessions differ from expansions.

New research by Mercer showed 87% of CFOs and CEOs believe the U.S. is already entering a recession, and half believe it will occur in the medium term. Meanwhile, slightly more than half of the 60 surveyed members of the National Association for Business Economics (NABE) peg the possibility of a recession over the next year at 50% or greater.

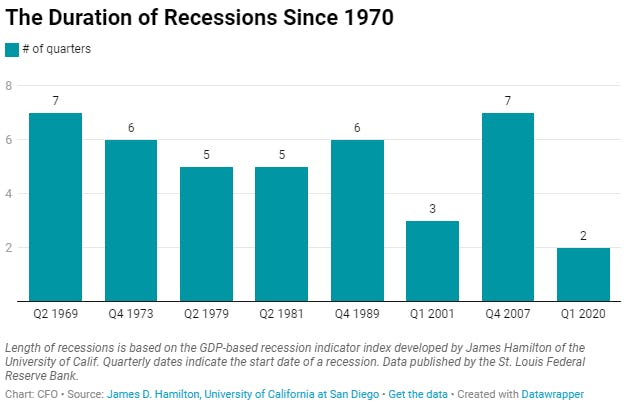

As you can see from the chart above, recessions are either short or long periods.

Q12020 was relieved by FED helicopter dollars into the system.

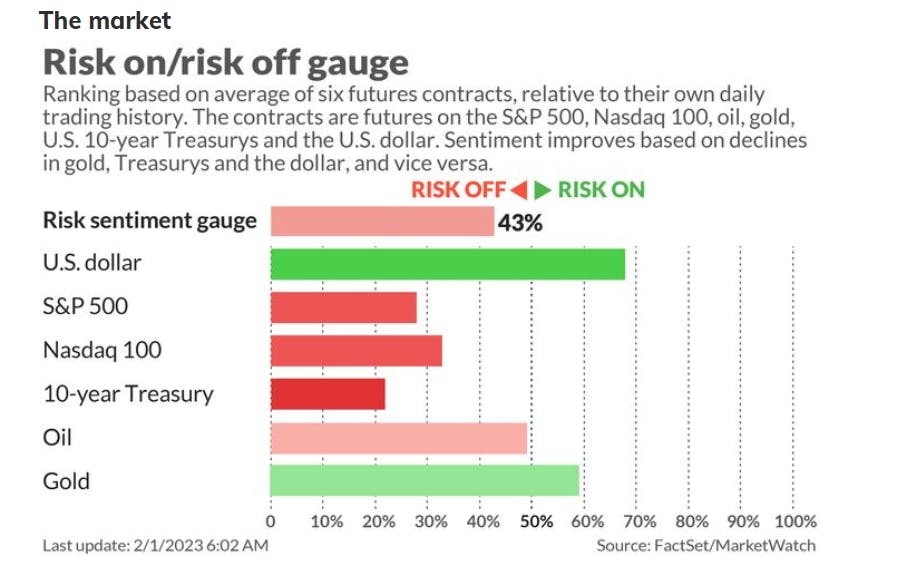

So, what did the market buy on lately?

A more dovish-than-expected message from Federal Reserve Chairman Jerome Powell stands to further boost hopes of slowing rate hikes and a so-called economic soft landing that have fueled a powerful rebound in U.S. stocks.

As stated by the FED, they don't seem to be dropping interest rates in 2023. So, what will save the markets?

"Easing inflation and cooling growth will allow the Fed to pull back from its hawkish monetary policy outlook"

"At this point, the market has welcomed the fact that a couple of more increases at 25 basis points basically means just marginal adjustments," said Alessio de Longis, senior portfolio manager at Invesco Investment Solutions. "The light at the end of this monetary cycle is coming."

Recession may not be real, It should just be hugely anticipated by the market participants (Wall Street) at that point, anything can break the market, as Mike Burry says the fed will continue helicopter if that happens.

Unemployment rates do not show a recession but you already know the TECH layoffs.

Be very sure about this, FED hates deflation more than it hates inflation.

So they will be combating deflation! We are right now in disinflation, not deflation. FED hates that!