Powell trying to be Volcker

Everyone has a dream!

Fed lifted its benchmark federal funds rate from near zero to a range between 4.5% and 4.75%, a level last reached in 2007. That extends the central bank’s most rapid pace of rate increases since the early 1980s to fight inflation that hit a 40-year high last year.

“The committee anticipates that ongoing increases” in interest rates “will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive,” said the statement, using the same language included in policy statements since last March.

“We’re going to be cautious about declaring victory and sending signals that we think the game is won,” he said. “Certainty is just not appropriate here.”

Wall Street sentiment

In spite of that chat above, bulls only heard what they wanted to hear.

Real Powell revealed himself during his interview with David Rubenstein at the Economic Club in Washington. I have never seen Volcker like that! He was rock solid.

Powell is too soft to be hawkish.

Remember Disinflation has begun only in the goods sector, about 25% of the economy. Long way to go and it will not be smooth, it will be bumpy and move lower. We need to see the disinflation in the services sector which is still not moving enough, considering the lagging of the hiking on effect in the economy.

Full employment triggers inflation

The labor market is extraordinarily strong. We already mentioned that Americans take any job they can find because the normal living standards are so up. Thanks to helicopter money! Made the rich richer and the poor poorer.

Powell says that he sometimes gets the data the night before but only him with no clarification on which types of data he receives. So basically, the data providers are wrong, blame them.

He is still using the data dependency weapon against hard questions.

He also says we may be beyond max employment. Thus giving signals that more people will be lay offed!

This is not a QT, it's a kind of QT (A Soft QT)

Employment and Wages Matter Most

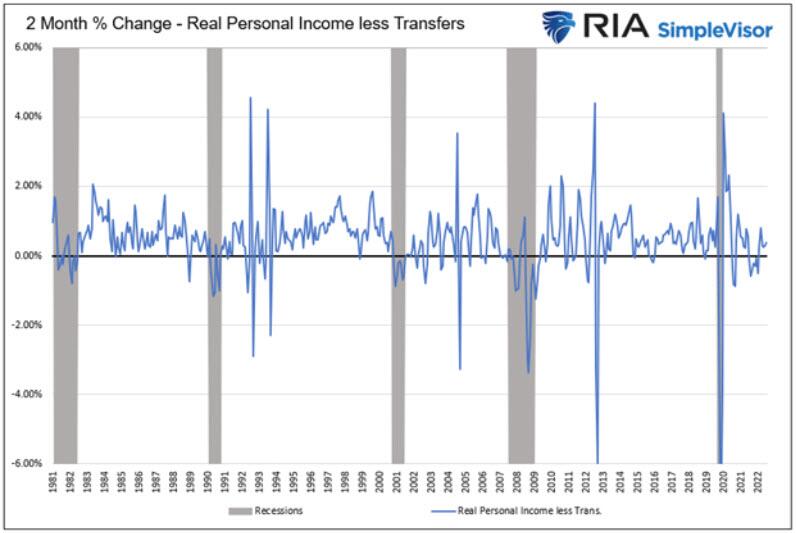

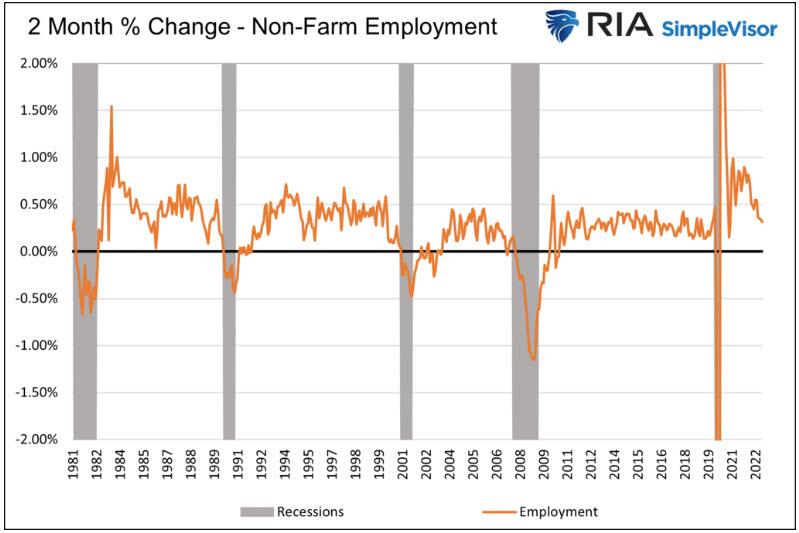

The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production.

Real personal income minus transfers tends to decline during recessions, but it has also dropped outside of recessions on multiple occasions. It is not a perfect indicator.

Nonfarm Payroll Employment measures the number of employees excluding farm workers and a few other job classifications. The graph below shows that negative employment growth for two quarters or more coincides with NBER recessions. A few negative readings did not correspond with recessions, but they all happened shortly after a recession.

The peak in the funds rate could be higher?

C'mon Powell, we all know the FED will do exactly how the market wants it to do. You can't break the markets. Or can you?

How many Powells are there?

Last August, Powell leaned strongly into doing whatever it takes to bring inflation down and emphasized that inflation was unlikely to subside without some “pain” in labor markets.

Labor demand far exceeds labor supply thus bringing competition for employees and the wages go up! Although wage growth has moderated , it continues to run at rates above what the Fed believes is needed to achieve its inflation mandate.

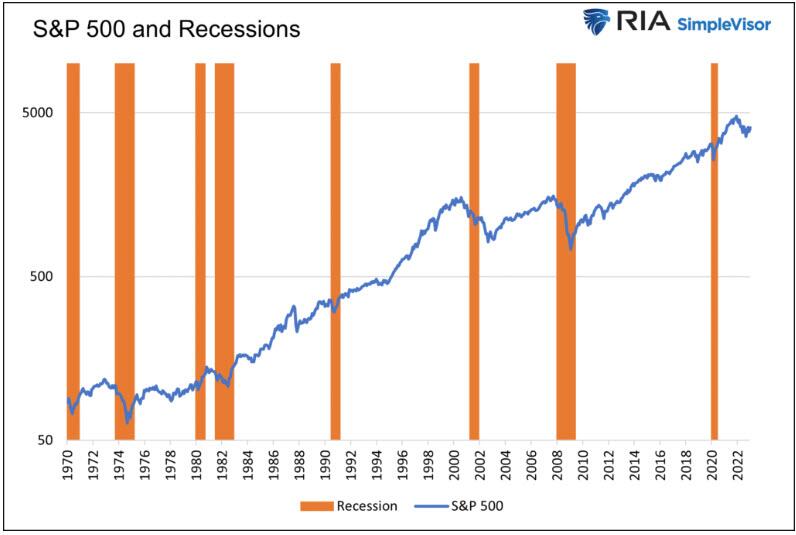

4300 appears to be the market's next destination.

As shown below, stocks tend to decline three to six months before a recession starts. Being late on a recession call or failing to forecast a recession can prove costly.

As the FED does, MarketSumm also is data-dependent and will be for the best of you and your money.

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decisions based solely on what you read here. Neither MarketSumm nor its employees and writers receive any compensation for securities or investments covered herein.

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decisions based solely on what you read here. Neither MarketSumm nor its employees and writers receive any compensation for securities or investments covered herein.